How Does TennCare Work?

In Tennessee, TennCare serves as a rebranded version of Medicaid. Originally established by President Lyndon Johnson in 1965, Medicaid aims to offer health coverage to low-income families and individuals, encompassing children, parents, pregnant women, seniors, and people with disabilities. The program is funded jointly by the federal government and the states.

When Congress passed Medicaid, they granted the states considerable flexibility to interpret the statute. Consequently, it can be challenging to find comprehensive information about Medicaid online. Notably, significant differences exist between Medicaid in Kentucky and TennCare.

During the 1980s, stories emerged of impoverished women resorting to eating cat food due to their husbands being on Medicaid. In response, Congress implemented anti-impoverishment provisions to prevent spousal impoverishment. This remains a largely overlooked aspect of American law.

How does TennCare Function?

Now let’s delve into how TennCare functions. Three programs are typically of interest to our clients: Choices 1, 2, and 3. Choice 1 is designed for seniors and individuals with disabilities residing in nursing homes, while Choice 2 caters to those who meet the same criteria but wish to receive care at home under the Home and Community-Based Services (HCBS). The requirements for both programs are detailed below.

Under Choice 1, the applicant’s income usually goes toward covering nursing home expenses, with TennCare supplementing any amount over $50 per month. For Choice 2, TennCare provides caregivers and minor home modifications like walk-in showers, subject to a “cost neutrality cap” limiting expenditure on home-based care compared to nursing home care.

The third category, Choices 3, benefits those at risk of entering a nursing home. Initially reserved for individuals on Supplemental Security Income (SSI), this program has recently expanded to include non-SSI recipients with an annual cap of $19,764 for maximum payment.

We mainly work with individuals seeking assistance under Choices 1 or 2. Qualifying requirements for these programs revolve around having an illness severe enough to necessitate long-term care, maintaining a low-income level, and possessing assets below a specified threshold.

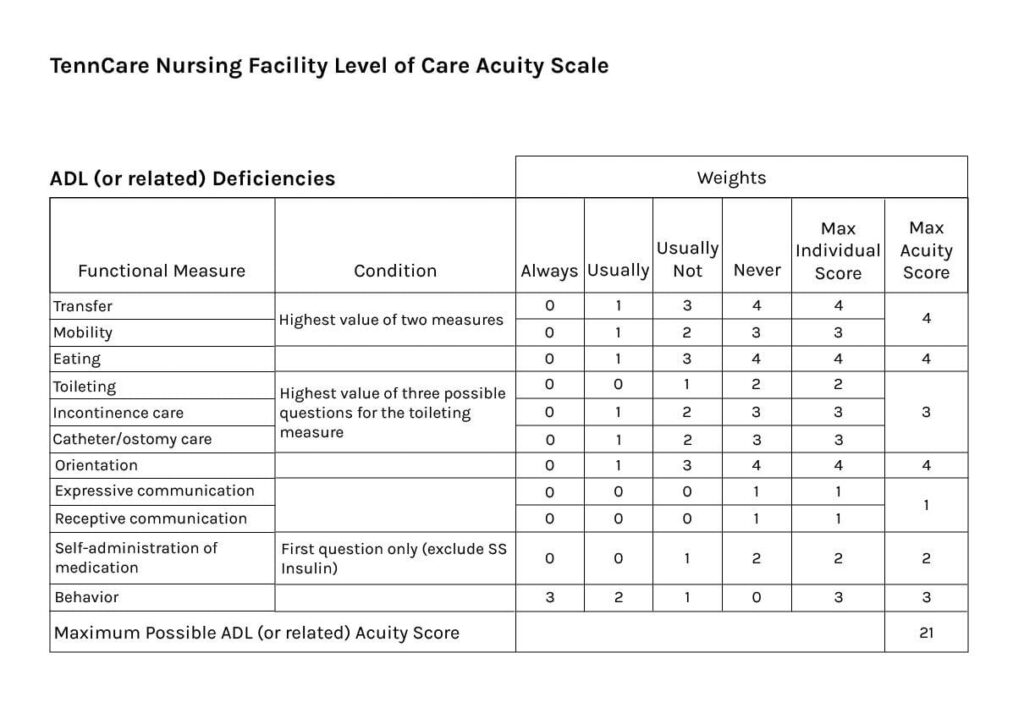

Notably, meeting the criterion of being “ill enough” is becoming increasingly stringent. Applicants must score nine points or less on a Pre-Admission Evaluation (PAE) unless there are safety concerns related to living at home, in which case they need to score six points. Financially, applicants cannot have an income exceeding $2,829 per month (as of 2024). To cover the substantial costs associated with nursing home care, applicants can establish a Qualified Income Trust (QIT) by depositing excess funds into a separate bank account.

What can limit your eligibility for TennCare?

Asset limits also factor into TennCare eligibility. A single person is permitted to have no more than $2,000 in “countable” assets. With married couples, total countable assets are calculated for both spouses; the spouse at home retains half within a specified range ($30,828-$154,140 as of 2024), while the spouse in a nursing home can retain only $2,000.

Is it Time to Plan for Your Future with Elder Law of Nashville?

Navigating TennCare eligibility involves complex legal considerations that are not suitable for a DIY approach. Our expertise can guide you through this intricate process – we even help relatively affluent individuals qualify for TennCare. If you believe TennCare might feature in your future plans or want assistance navigating its eligibility requirements, please don’t hesitate to contact us.